Donchian Volume Void

Description

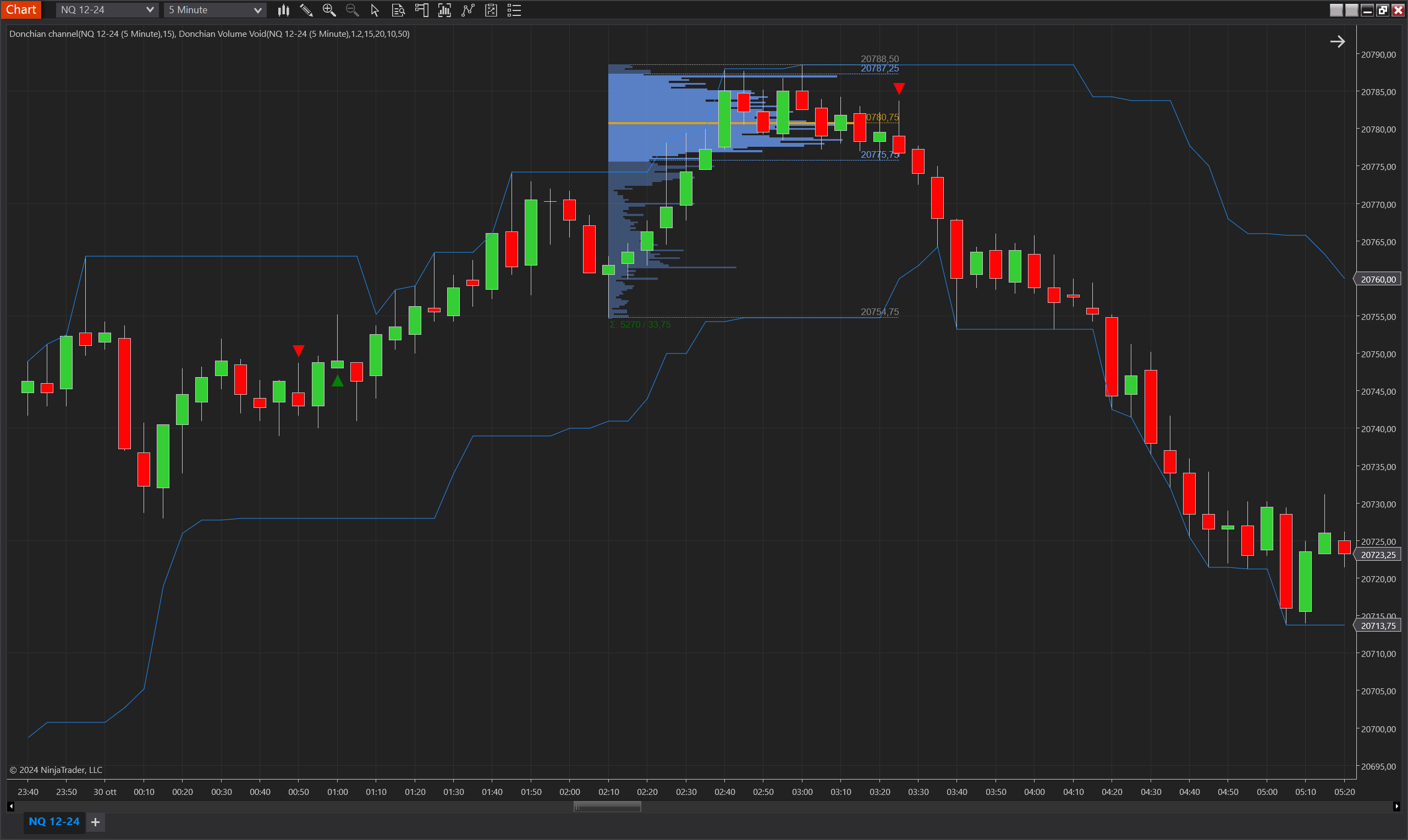

The Donchian Volume Void indicator for NinjaTrader 8 is a specialized tool designed to validate potential trading signals based on volumetric voids within the context of the Donchian Channel. It identifies both long and short setups by analyzing bar behavior where the closing price is either above or below the opening price. The indicator calculates target and stop levels in ticks and assesses the volume at these levels. For long signals, it ensures the volume at the target level is significantly less than at the stop level, suggesting a potential upward breakout. For short signals, it confirms that the volume at the target level is notably lower than at the stop level, indicating a potential downward breakout. This indicator serves as a confirmation tool, enhancing the reliability of primary trading signals by validating them with volume-based analysis.

Key Features

- Dual Signal Detection: Identifies long and short trading setups by analyzing price behavior in relation to the Donchian Channel's upper and lower boundaries.

- Volumetric Analysis: Compares volume at target and stop levels to ensure that target volume is lower than stop volume, indicating breakout potential.

- Dynamic Target and Stop Calculation: Computes target and stop values in ticks for accurate level identification.

- Volume Void Check: Ensures that the target level's volume is not only lower but also within a user-defined ratio compared to the stop level.

- Visual Signal Plots: Displays upward green triangles for long signals and downward red triangles for short signals, providing clear visual cues on the chart.

- Confirmation Tool: Used to confirm primary signals, adding an additional layer of analysis to improve trading decisions.

Tips for Implementation

- Parameter Adjustment: Customize the Period, StopLoss, and ProfitTarget parameters to align with your trading timeframe and strategy. Adjust the MinVolumeRatio to control the strictness of volume comparison for signal validation.

- Volume Profile Consideration: Ensure that the volume profile data used aligns with the analysis to maintain accuracy in volume comparisons.

- Combining Strategies: Use this indicator as a confirmation tool alongside other trend-following or momentum indicators to enhance entry and exit accuracy.

- Backtesting and Optimization: Thoroughly backtest the indicator under different market conditions to optimize parameter settings and ensure robustness across varying levels of volatility.

Parameters

Period:

- Type: int

- Description: The period for the Donchian Channel and associated volume profile analysis.

- Default Value: 10

- Valid Values: Any positive integer

Stop Loss (ticks):

- Type: int

- Description: The number of ticks used to determine the stop level for signal evaluation.

- Default Value: 5

- Valid Values: Any positive integer

Profit Target (ticks):

- Type: int

- Description: The number of ticks used to determine the target level for signal evaluation.

- Default Value: 10

- Valid Values: Any positive integer

Min Volume Ratio:

- Type: double

- Description: The minimum ratio of stop volume to target volume required for signal confirmation.

- Default Value: 1.2

- Valid Values: Any positive double

Target Max POC Percentage:

- Type: int

- Description: The percentage of the Point of Control (POC) volume used as a threshold for target volume validity.

- Default Value: 50

- Valid Values: Any positive integer

Plot Offset (Ticks):

- Type: int

- Description: The offset in ticks for the signal plot position relative to the high or low of the bar.

- Default Value: 3

- Valid Values: Any positive integer

Plots

IndicatorSignalUp:

- Type: Plot

- Style: Triangle Up

- Color: Green

- Description: Marks potential long trading signals based on volumetric void confirmation.

IndicatorSignalDown:

- Type: Plot

- Style: Triangle Down

- Color: Red

- Description: Marks potential short trading signals based on volumetric void confirmation.