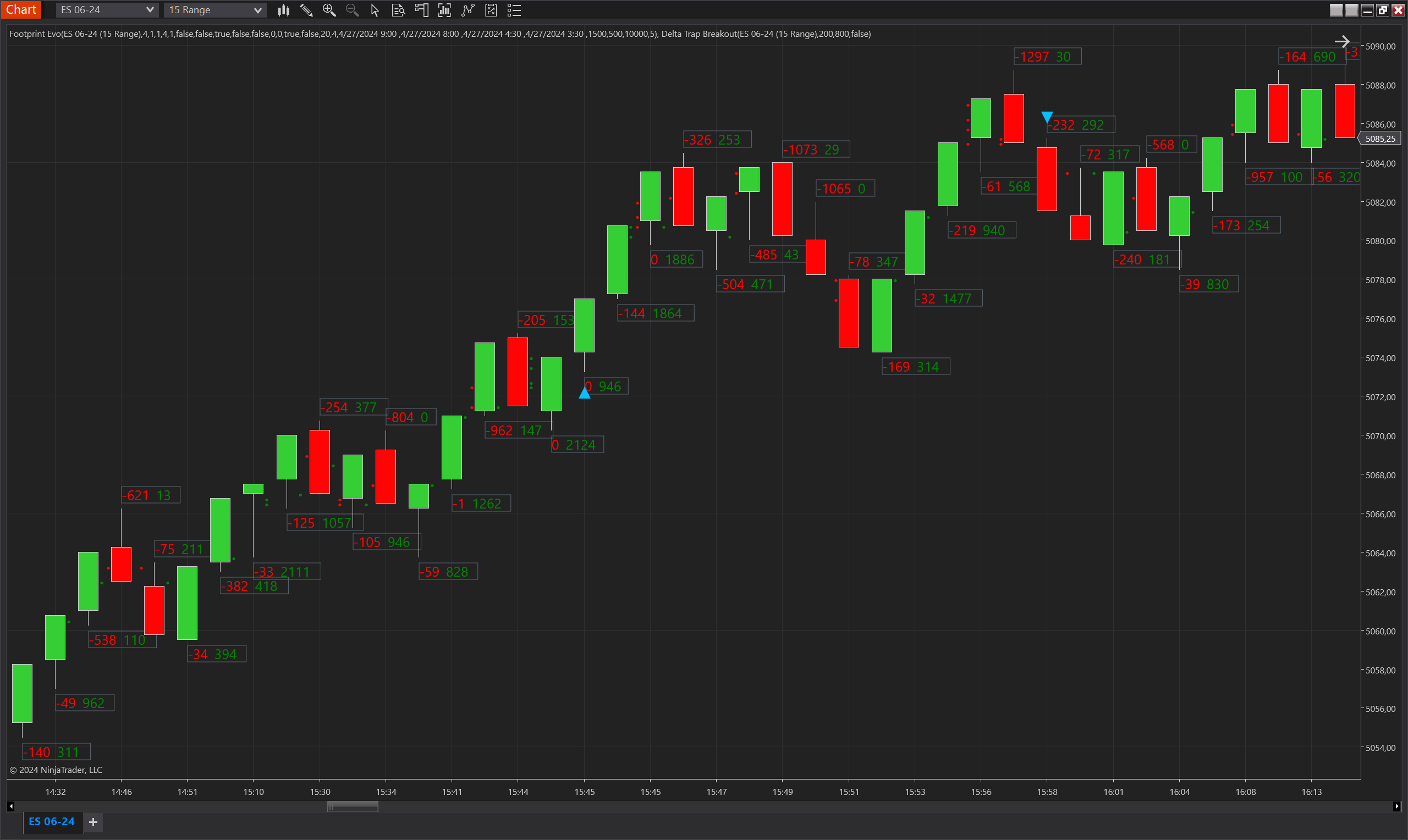

Delta Trap Breakout

Description

The Delta Trap Breakout indicator identifies significant market movements where large delta imbalances are followed by a breakout, signalling a potential continuation or reversal. This tool is especially useful in markets where delta imbalances indicate potential areas of support or resistance, often leading to a strong price movement once these levels are breached.

Key Features

- Trapped Delta Detection: Identifies bars with a delta exceeding a specified threshold, signalling high buying or selling pressure.

- Breakout Confirmation: Confirms the potential move by requiring the price to break past the high or low of the trapped delta bar, enhancing the reliability of the signal.

- Flexible Adjustment: Allows customization of delta thresholds and the method of calculating the reversal delta to adapt to varying market conditions and trading styles.

Tips for Implementation

- Adjust Parameters: Fine-tune the Min Trapped Delta and Min Reverse Delta Increase to match the volatility and characteristics of the trading instrument.

- Confirmation with Other Indicators: Use in conjunction with other indicators such as volume, moving averages, or RSI to confirm the strength and potential of the breakout.

- Backtesting: Always backtest the indicator under different market conditions to understand its effectiveness and to adjust parameters accordingly.

- Stop Loss and Take Profit: Establish clear stop-loss points just beyond the breakout levels and set take-profit levels at significant resistance or support points to manage risk effectively.

Parameters

Min Trapped Delta

- Type: Integer

- Description: Minimum delta value that must be trapped within a bar to consider it for a breakout potential.

- Default Value: 1000

Min Reverse Delta Increase

- Type: Integer

- Description: Minimum increase in delta required to validate a breakout after a trapped delta.

- Default Value: 200

Sum Reverse Delta

- Type: Boolean

- Description: Determines whether to sum the deltas of consecutive bars to meet the reverse delta increase requirement.

- Default Value: False

Plot Offset (Ticks)

- Type: Integer

- Description: Distance in ticks to offset the plot from the high or low of the breakout bar, improving visibility and distinction from actual price bars.

- Default Value: 3

Plots

IndicatorSignalUp

- Type: Plot

- Style: Triangle Up

- Color: DeepSkyBlue

- Description: Signifies a bullish breakout signal where the closing price moves above the high of the delta trapped bar.

IndicatorSignalDown

- Type: Plot

- Style: Triangle Down

- Color: DeepSkyBlue

- Description: Indicates a bearish breakout signal where the closing price drops below the low of the delta trapped bar.